income tax rate indonesia

Effective fiscal year 2022 the lowest tax bracket cap for individual income tax will be increased from IDR 50 million to IDR 60 million and a new 35 tax bracket will be added for individuals earning more than IDR 5 billion annually. The changes include a new top individual income tax rate of 35 on income over IDR 5 billion in addition to an increase in the upper threshold for the 5 rate from IDR 50 million to IDR 60 million.

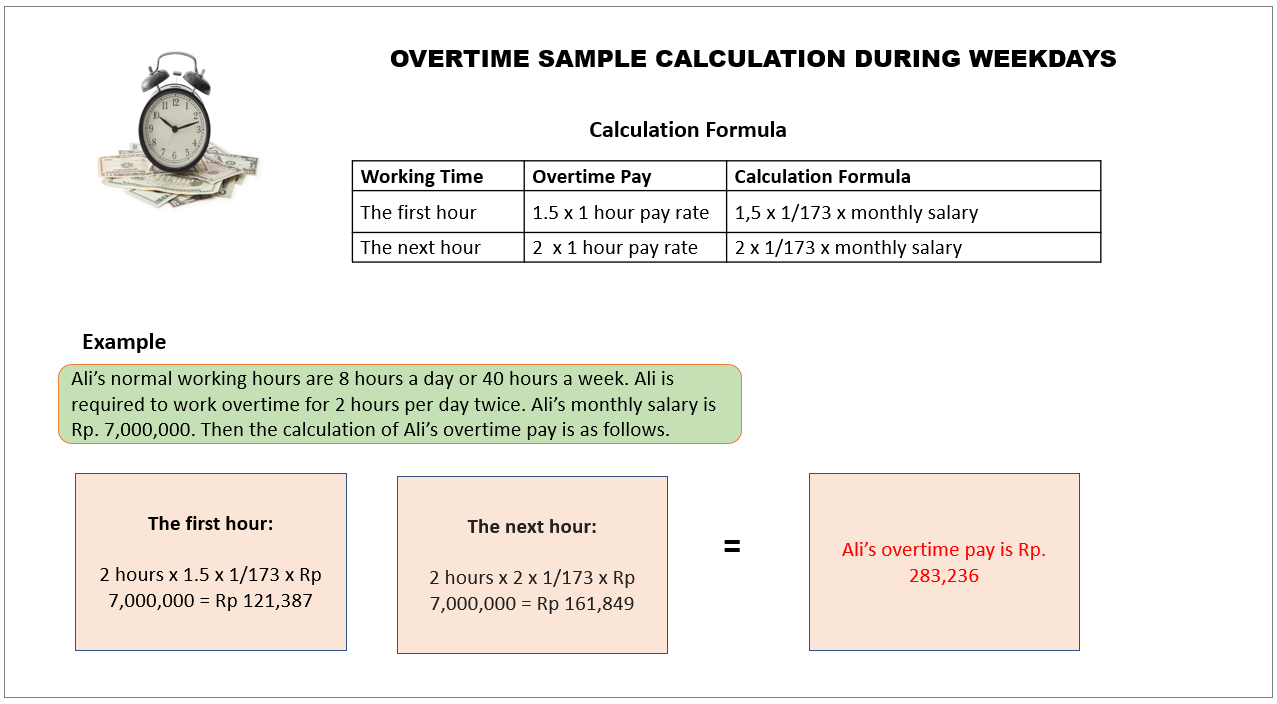

Indonesia Payroll And Tax Guide

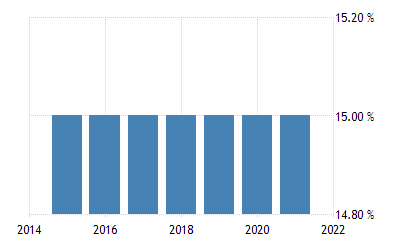

80 rows Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals.

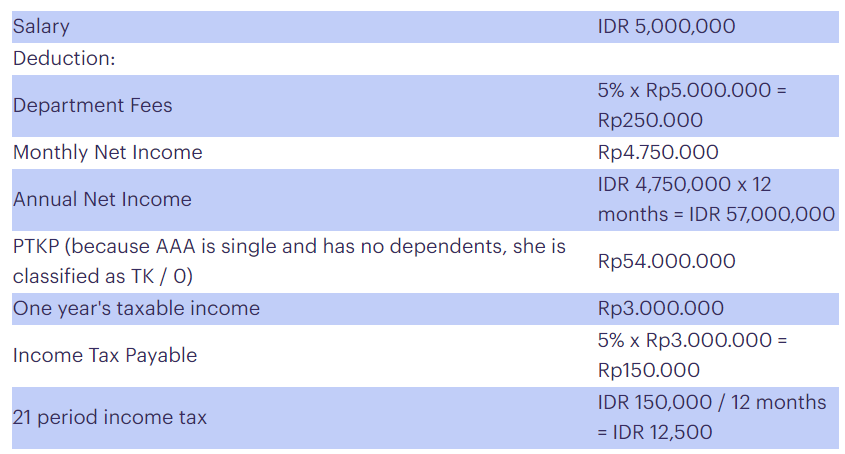

. Taxable Income Rate Up to Rp 50000000 5 Over Rp 50000000 but not exceeding Rp 250000000 15 Over Rp 250000000 but not exceeding Rp 500000000 25 Over Rp 500000000 30. Income Tax Rates and Thresholds Annual Tax Rate. PPh 26 Income Tax is taxed at a flat rate of 20.

The current rate is down from 1 to 05 for both individual taxpayers as well as companies with gross income below IDR 48 billion a year US 3390298. For fiscal year 20202021 the CIT rate is 22 and for the year 2022 onwards the CIT rate will be 20. Try to calculate your personal tax for free now.

The Personal Income Tax Rate in Indonesia stands at 30 percent. From January 2022 new progressive income tax rates come into effect in Indonesia. Income tax in Indonesia is mostly paid by the employer.

Annual Taxable Income Rate. Normal rate of taxation in Indonesia corporate income is 25. 5 rows In general a corporate income tax rate of 25 percent applies in Indonesia.

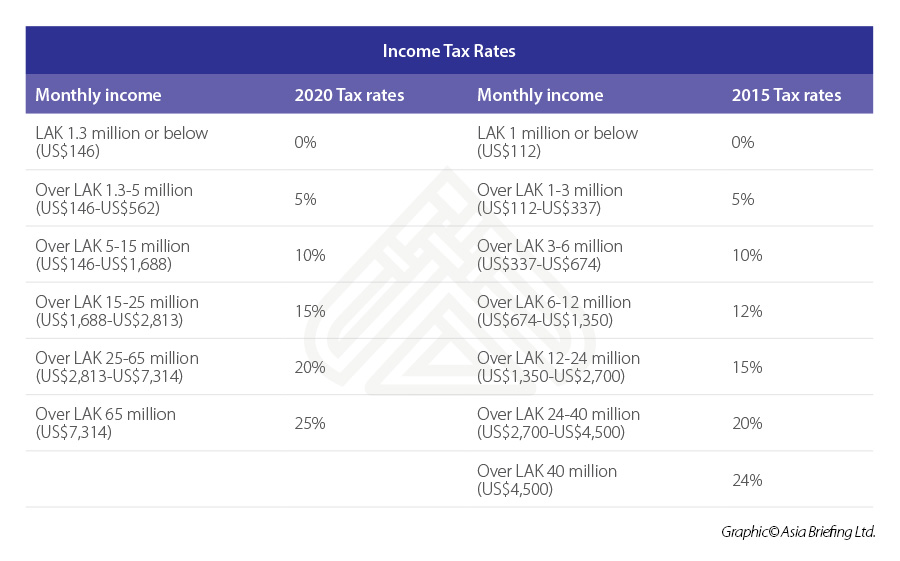

Final Tax is imposed. Below are applicable income tax rate for individual taxpayer. The new rates effective from January 2022 can be found in the table.

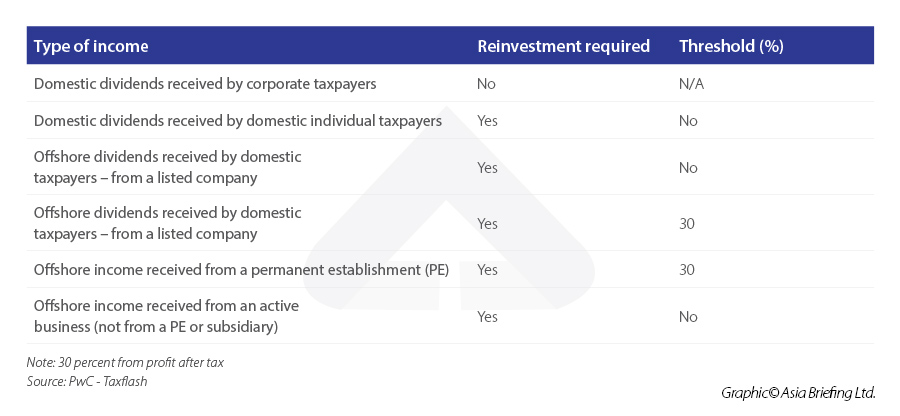

The provisions of tax treaties may override these rules. 5 rows Non-resident individuals are subject to a general withholding tax WHT at 20 in respect of their. As of 2016iii the non-taxable income threshold is IDR 54000000 per year for single individuals and IDR 58500000 per year for married individuals.

Public companies that have a minimum listing requirement of 40 and other specific conditions are eligible to a 3 cut off from the standard CIT rate. 26 WHT of 20 is applicable. The tax withheld by employers must be remitted to the.

A flat CIT rate of 22 generally applies to net taxable income. However the transfer of assets as a result of MA is not. The corporate income tax CIT rate in Indonesia is 25.

Indonesia Residents Income Tax Tables in 2020. Non-taxable Incomes and Reliefs. New Reduced Income Tax Rate in Indonesia.

Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are taxed on 20. 07 Jan 22. Indonesia Residents Income Tax Tables in 2022.

Income Tax Rates and Thresholds Annual Tax Rate. Non-resident individuals are subject to withholding tax at a rate of 20 Article 26 income tax subject to a relevant tax treaty provisions on Indonesia-sourced income. The progressive tax rate is currently structured around four income bands with rates that apply to the fractional income within each band.

However certain tax objects or industries have special tax regimes. Estimate your own income tax in Indonesia for the current year through our Personal Income Tax Calculator. Value Added Tax VAT The VAT rate in Indonesia increased from 10 to 11 on 1 April 2022 and will rise to 12 by 1 January 2025.

Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent in 2005 and a record low of 30 percent in 2009. Transfers of assets in the form of land and buildings are subject to Final Income Tax at a rate of 25 on the transfer value. Non-residents are subject to a final withholding flat tax of 20 percent on gross income.

PT Cekindo Business International. This applicable tax rates are progressive based on annual income. Companies that have a gross turnover below 50 Billion IDR have a discount on 50 from the standard corporate income tax in other words 125.

Heshe is present in Indonesia during a fiscal year and intends to reside in Indonesia. Tax rates The corporate income tax rate which was expected to be reduced to 20 will remain at 22. Public companies that satisfy a minimum listing requirement of 40 and certain other conditions are entitled to a tax discount of 3 off the standard rate providing an effective tax rate of 19.

Indonesia Individual Income Tax Guide 9 Individual Tax Rates Resident Taxpayer The standard tax rates on taxable income received by resident taxpayers are as follows. For resident taxpayer the top marginal income tax rate is 30 for income above IDR 500 million. According to government regulation Peraturan Pemerintah 232018 a new tax rate is about to apply for the income tax.

How To Calculate Foreigner S Income Tax In China China Admissions

Indonesia Income Tax Rates For 2022 Activpayroll

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Indonesia Payroll And Tax Guide

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

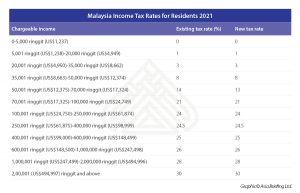

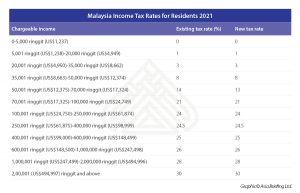

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Corporate Income Tax In Indonesia Acclime Indonesia

How To Calculate Income Tax In Excel

Indonesia Income Tax Rates For 2022 Activpayroll

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Tax Identification Numbers In Laos Compliance By June 2021

Indonesia Payroll What Is Ptkp How It Is Applicable In Deskera People

Indonesia Payroll And Tax Guide

Corporate Income Tax In Indonesia Acclime Indonesia